- Daily Dough - Become a Better Investor in 5 Minutes a Day

- Pages

- What are Market Bubbles?

Today we're taking a trip to the land of market bubbles – a mesmerizing realm that, despite its alluring glitz and glamour, could leave you with empty pockets faster than a pickpocket in a crowded subway.

If you've been around the investment block for a while, you've heard the term 'market bubble' thrown around like hot potatoes.

But what is it exactly?

Well, to put it in layman's terms, it's when folks get overexcited about an asset, inflate its value like a helium balloon at a birthday party, only to watch it pop when the harsh reality of economics steps in.

Bummer, ain't it?

But don't take it from me, let's hear it from our main man, Howard Marks, a Wall Street wizard who has been slinging spells in the finance world for decades.

In his latest book, “Mastering The Market Cylce: Getting the Odds on Your Side”, he dissected market bubbles with the precision of a sushi chef.

Marks tells us that it all starts with a spark - a novel idea, a technological breakthrough, a cultural shift.

That spark ignites the imaginations of investors, and we all begin chasing the golden goose, driving prices through the roof.

Fueled by fear of missing out (or FOMO), investors jump on the bandwagon.

You wouldn't want to be the only one missing out on the 'next big thing', would you?

But, as Marks sagely warns, this hype train often careens off the tracks.

You see, there comes a point when the actual value of an asset and its inflated price part ways like star-crossed lovers. The bubble is formed, and it's only a matter of time before someone comes along with a pin.

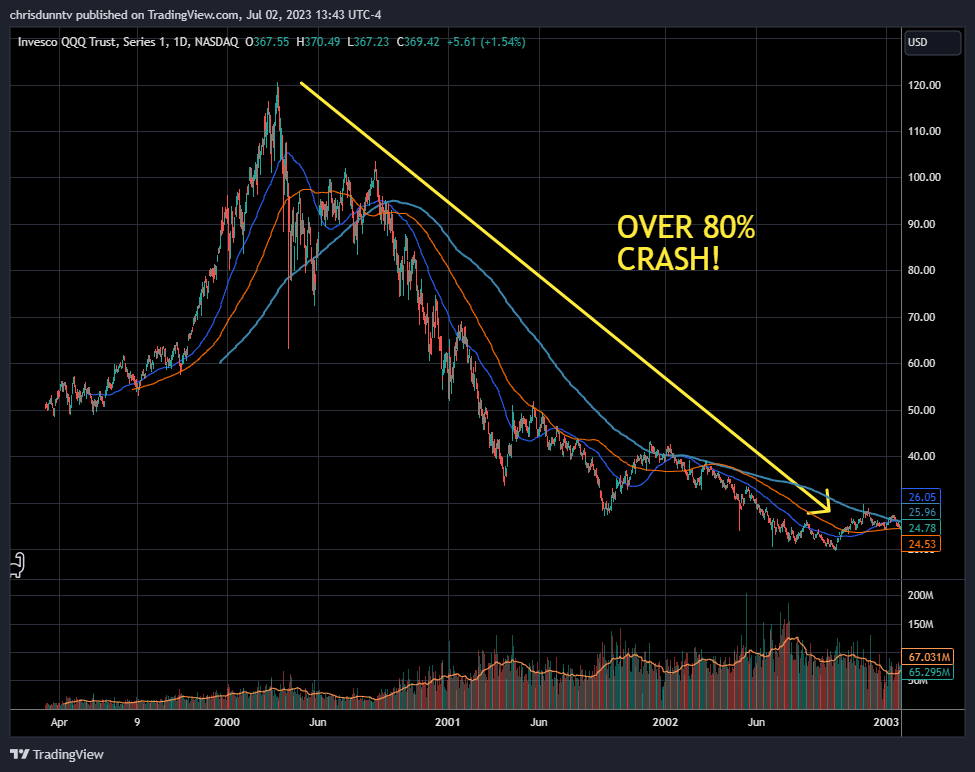

Remember the dotcom bubble?

Investors were so giddy about the World Wide Web, they were willing to pour cash into any venture with a dotcom suffix, only for it to end in a crash that made a demolition derby look like a minor fender bender.

How about the housing bubble of 2008?

Yeah, you get the point.

The trouble with bubbles is they're hard to spot when you're inside one, much like trying to read the label on a jar while you're sitting in it.

Marks agrees, pointing out that spotting a bubble in real-time requires a contrarian mindset, a skepticism of popular sentiment. If everyone is buying, it might be time to hold onto your wallet a little tighter.

So, how can you shield your hard-earned dough from these volatile financial cyclones?

By playing the long game.

Like a turtle in a race against hares, playing the long game might not get you instant wins, but it will keep you in the race long after the hares have exhausted themselves.

Take a leaf out of Marks' book - forget about short-term events and hyperactivity. These things don't add to your long-term success, and you shouldn't emphasize them.

Instead, focus on fundamentals. Identify companies that will become more valuable over the years, and those that can pay you back your loans.

That's investing in a nutshell.

So next time someone tries to lure you into the latest investment frenzy, remember that all that glitters ain't gold.

Focus on your strategy, keep your head cool, and let the market mania pass you by.

After all, a bubble might be fun to watch, but you certainly don't want to be inside when it pops.

Stay savvy, my friends. Let's keep the dough rolling!