- Daily Dough - Become a Better Investor in 5 Minutes a Day

- Posts

- ⛰️ Can BASE Take Coinbase to New Heights?

⛰️ Can BASE Take Coinbase to New Heights?

Investing can be a lonely game…

Which is why we launched the Wealth Building Community.

Get mentorship from our team of investors, traders, and entrepreneurs.

What’s on the Menu 🍴

Happy Friday, dough-growers! 🍞

Stocks and crypto are playing limbo, seeing how low they can go.

But hey, whether they're moonwalking or skydiving, we've got your back.

Here's today's slice: 🥖📈

Can BASE Take Coinbase to New Heights? ⛰️

Target Vs. Walmart: Opportunity Emerging? 🥊

When Good News Is Bad News 📰

Should you quit your job to trade or invest full time? 🚫

Today’s newsletter is a 5 minute read.

Can BASE Take Coinbase to New Heights? ⛰️

Ever felt like Ethereum was a bit... expensive?

Well, Coinbase just took things to the next level and unveiled their Layer 2 blockchain, BASE.

Why the Hype?

Onboarding Millions to DeFi: Coinbase, with its 100 million users, is known for its simplicity. BASE aims to bring a chunk of them on-chain, potentially overshadowing the current DeFi user base of only about 5 million active monthly users.

Workaround for Regulations: While Coinbase can't list every crypto token due to regulations, BASE potentially offers US citizens access to more projects through DEX’s (Decentralized Exchanges).

No Token? No Problem!: It doesn’t look like BASE will have its own token. But if you're itching to speculate, keep an eye on optimism's OP token, which is closely tied to BASE's operations.

There are also hundreds of projects tied to Base that will likely attract investors’ attention.

Ethereum's Lil' Brother: BASE is a Layer 2 Protocol on Ethereum's network. So, Ethereum might just get more transaction volume and value from the action on Base.

The Good: BASE is a treasure trove of opportunities. Newer DEX projects in the Base ecosystem like BaseSwap are growing like Jack's beanstalk.

The Bad & Ugly: Scam coins. Yep, BASE had a rough start with over 500 scam tokens deployed in just a month. Rug pulls and memecoin pump-and-dumps have been booming on the platform.

Stock Implications: Coinbase's stock might just get a BASE boost. With BASE's potential to revolutionize the crypto landscape, Coinbase's ecosystem (and revenue) stands to benefit massively.

In a Nutshell: BASE is a new playground where we can test new crypto projects. We’ve seen this story play out with projects like Binance’s BNB Smart Chain…

And while it promises a world of opportunities, always tread with caution.

Target Vs. Walmart: Opportunity Emerging? 🥊

We’re in the thick of one of the most important parts of earnings season right now: retail companies (think essential & discretionary spending).

Nothing gives us more insight into the consumer as hearing from Walmart, Target, Kohls, TJ Max and the like.

One thing we’re seeing: The consumer is being very choosy where they spend money…and they like getting a good deal.

We’ve got plenty of examples of winners and loser out there.

None quite as interesting and telling as Target vs. Walmart.

We now have Q2 earnings from both companies.

Revenue growth doesn’t tell the whole story of a company (we need to look at things like margins and net profits).. but, it’s a great place to start for the larger picture.

We immediately can see the stark difference between revenue performance:

Walmart is UP 5.4% year-over-year…

And Target is DOWN -4.9% year-over-year.

It’s clear that Walmart has gained some share, and stolen some business from Target.

The Bottom Line: Consumers are feeling the pinch from inflation, and having tighter budgets has pushed them to finding value from Walmart’s stores (this is what they’re sort of known for).

Target had benefited more from discretionary spending in 2020-2022, which has tapered down in 2023 as people buy less throw pillows and candles.

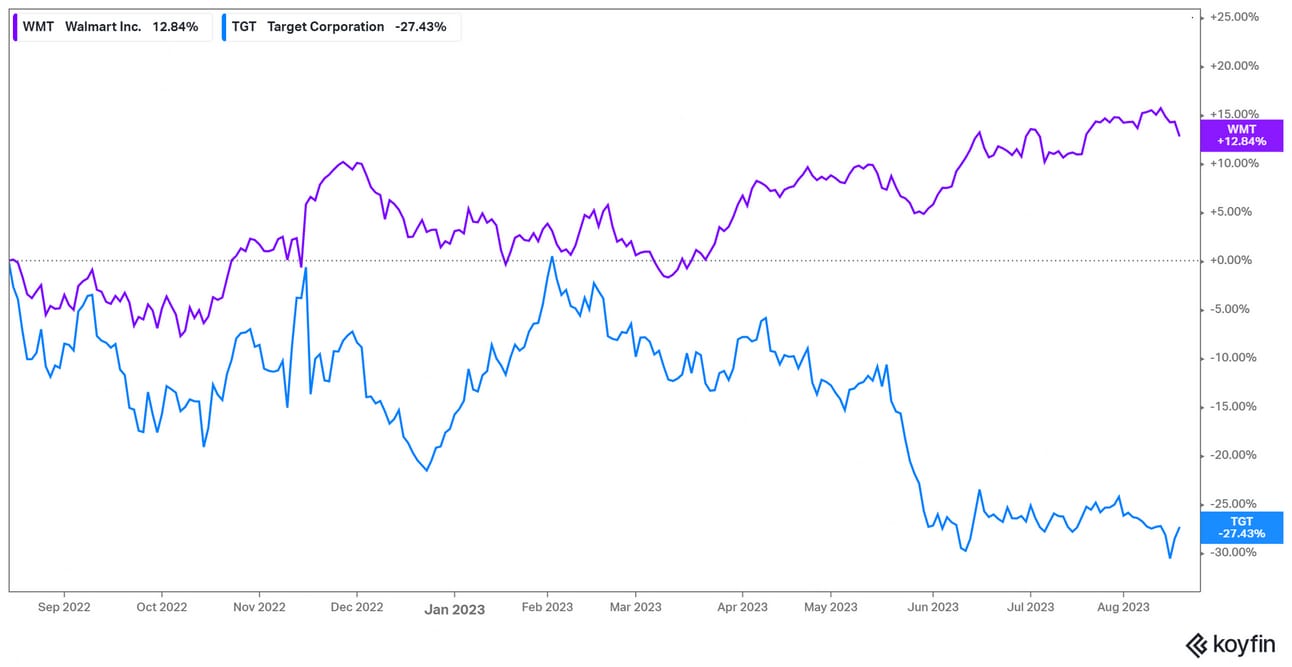

Looking at the stock price performance, it’s even more clear how the consumer has shifted their shopping:

1-year price returns are all we need to see:

Now, with this said… all is not lost for Target’s stock.

In fact, you could argue it’s showing some future value here if you know where to look.

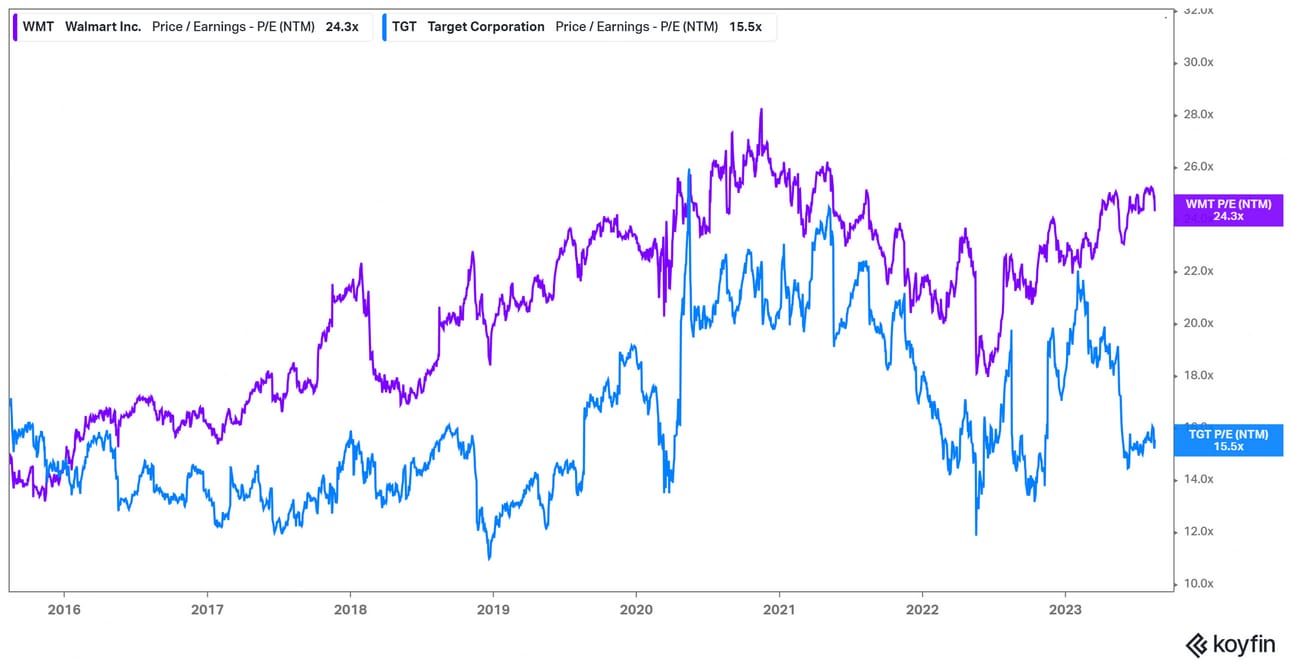

The price-to-earnings ratio alone is showing Walmart trading at an ABOVE MARKET multiple of 24.3x (meaning, a higher multiple than the S&P 500’s 19x).

While Target is sporting a P/E multiple that is on the lower end of its normal range.

Target has a few things going for it:

The rollout of more ULTA stores within TGT (double digit growth in ULTA beauty & beauty in general continues to be a strong category).

They’ll benefit from an eventual shift back from services to goods over time.

They’ll benefit from any recovery in housing going forward. (The death of Bed Bath and Beyond helps them here).

They’ll benefit from the back to school and holiday season. (This is where they SHINE).

Management still has work to do, especially addressing things like theft and keeping an inclusive approach to merchandise.

The Big Question: Target’s stock is at multi year lows. Is this stock price blunder a new investing opportunity as the economy “normalizes”?

Get access to more stock investing research and ideas by joining our Wealth Building Community!

When Good News Is Bad News 📰

Two weeks ago we wrote here in the Daily Dough that we were expecting a stock market correction as investor sentiment had turned greedy and bond yields were on the rise.

Our timing was on the money, as the S&P 500 and Nasdaq indices have pulled back 5-6%.

Now the question is, how much deeper will the correction go?

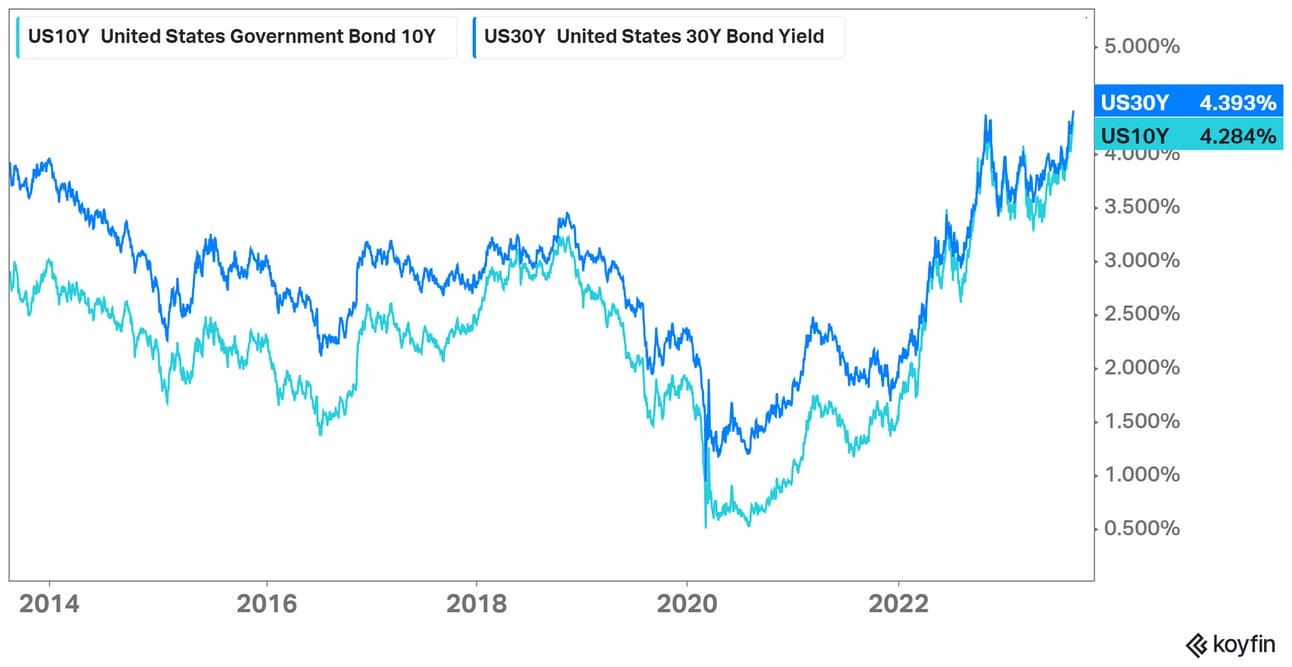

The biggest worry in the market right now definitely seems to be what’s happening with 10-year and 30-year US government bond yields:

These long term yields are now hitting decade highs, and could translate into higher borrowing costs for businesses and consumers.

The path of these bond yields could be a key driver of what happens in stocks for the rest of this year.

So what’s driving the rise in long term government bond yields?

We suspect it could be stronger than expected economic data.

In the past two weeks, a number of economic signals have looked bright, including:

Q3 GDP forecast from the Atlanta Fed (+5.8%!)

July retail sales (+3.2%)

Bank of America consumer credit & debit spending (+4%)

Building permits & housing starts

Philly Fed manufacturing gauge

Tighter corporate credit spreads

Low & stable weekly unemployment claims

It seems that good economic data could actually be the root cause of rising yields and thus the market pullback!

A weakening economy would be problematic, but an economy that is hot enough to reignite inflation fears and cause the Fed to continue raising rates would also be worrisome.

How do we think this gets resolved?

Higher yields translate into higher mortgage rates and lower asset prices on average. Those can have negative consequences in the housing and financial sectors.

So in some ways, this “problem” is self-correcting. It just takes time.

The Federal Reserve also has tools to calm the bond market if it gets too volatile.

We still think it’s likely that the current correction will continue for awhile but ultimately provide a lucrative dip buying opportunity.

Where the exact bottom will be is impossible to know.

But we’re compiling our shopping list now and setting price level alerts so that when the sentiment flips back to fear, we will be ready to pounce!

This Week’s We Talk Money Episode 🎙️

The investing world was abuzz when Michael Burry revealed his next “big short”…

Or so people thought.

The reality is MUCH different, which leaves people asking: “Should we be buying this dip or shorting the crash?”

We’re covering that and more in this week’s We Talk Money Episode!

Also, you’ll learn:

What does Coinbase’s new futures trading mean for crypto?

Why are home builders at all-time highs when rates are sky-rocketing?

Does it make sense to listen to boom-and-gloom boomers?

And we answer your questions!

Delicious Bites 😋

Should you quit your job to trade or invest full time?

China’s Housing Slump Is Much Worse Than Official Data Shows

Coinbase Quietly Got Regulated in the U.S.

Mortgage Rates Hit 7.09%, Highest in More Than 20 Years

China’s Evergrande files bankruptcy

Food For Thought 🧠

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.”

-Satoshi Nakamoto

How did you like today's newsletter?Let us know how we can deliver value. |

DISCLAIMER: We are not investment advisors, and this content is for educational purposes only. We don’t offer financial, legal, or tax advice. Nothing we say is a recommendation to buy or sell any assets. Trading and investing are extremely risky, so please be careful and do your own research.