- Daily Dough - Become a Better Investor in 5 Minutes a Day

- Posts

- 😵 How Sneaky Fees Eat Your Wealth

😵 How Sneaky Fees Eat Your Wealth

Growing your dough can be a lonely game.

That’s why we build the Wealth Building Community - to give you expert education and guidance on your journey.

From professional investors, successful entrepreneurs, and financial planners - the Wealth Building Community has it all!

We do weekly LIVE market review classes, live chat rooms, watchlists, alerts, and in-depth classes on all things finance.

Don’t go it alone. Join us today!

What’s on the Menu 🍴

We all have blind spots - areas of our lives we don’t see the looming problems.

And FEES are a commonly overlooked blind spot for people and their money.

So today we’re diving into hidden (and blatantly obvious) costs that eat your dough.

Let’s roll:

Sneaky Fees Eating Into Your Wealth 😵

What's Driving Up Mortgage Rates? 🏠

What To Watch This Week 👀

Can I Retire Early? 📺

Today’s newsletter is a 4 minute read.

Sneaky Fees Eating Into Your Wealth 😵

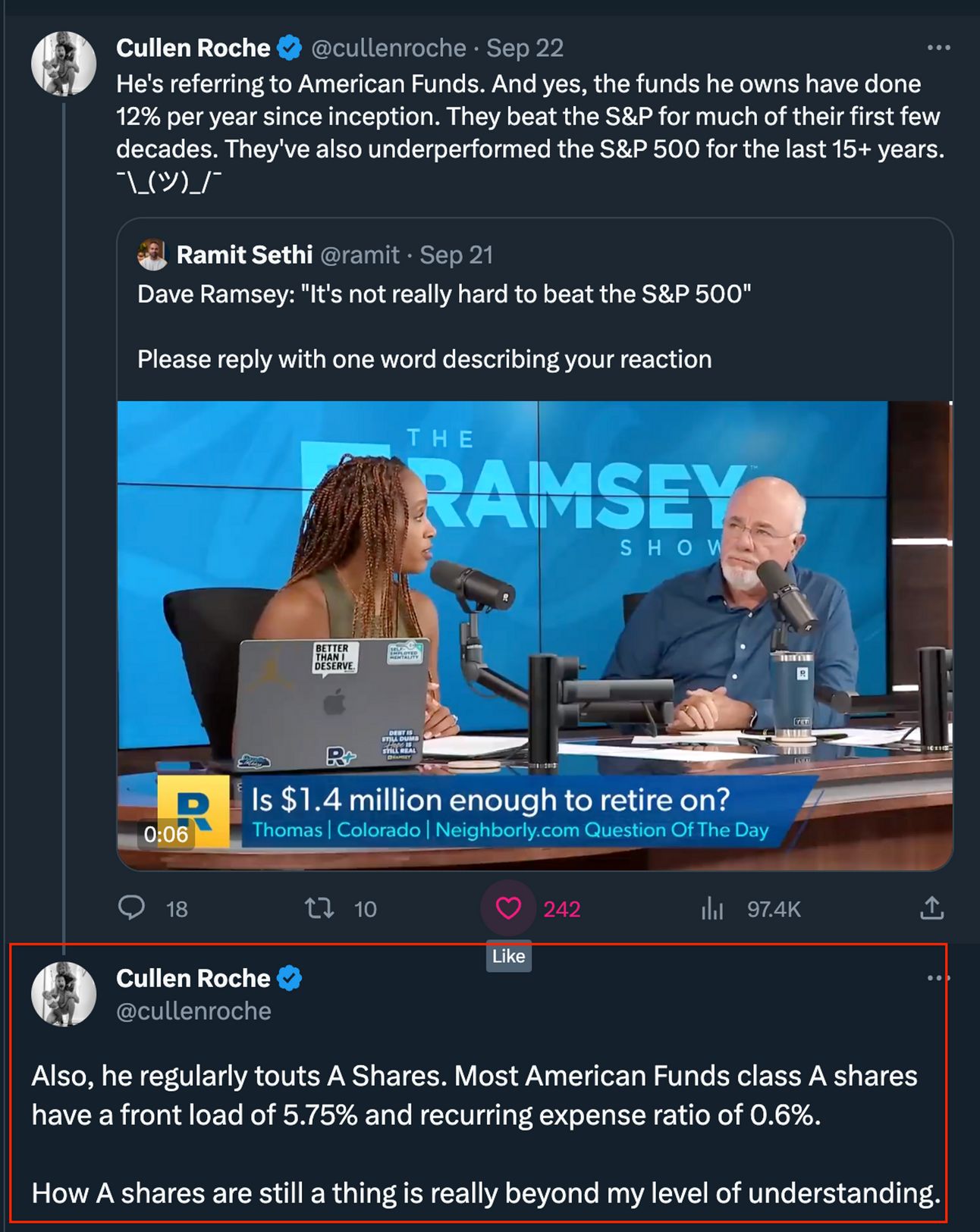

This week, a video of Dave Ramsey saying that “it’s not really hard to beat the S&P 500” went viral on Twitter(X).

This subject gives us an opportunity to help you avoid a HUGE investing mistake.

Our friend Cullen Roche pointed out that Dave was referring to mutual funds via the American Funds brand to “beat the market”.

American Funds are used a lot by workplace retirement plans.

Cullen also pointed out that Dave’s fund actually did not beat the S&P 500 for the past 15 years.

Many American funds products tout some of the biggest fees (expense ratios) in the industry.

For comparison… a Vanguard S&P 500 index fund (ETF) costs only 0.03%.

As I mentioned prior, this brand of funds is very popular with workplace retirement plans, which a lot of Americans have.

Not that these funds are inherently bad, but, they might be expensive for what they are.

High investing fees can truly eat into your wealth over time. So it’s important to be optimized here.

So, what should you do if you think you’re invested in funds with high fees?

Go check your funds in your retirement plan. What is the expense ratio? How does it compare to other similar funds?

Let’s look at an example of an American Funds 2060 Target Date Fund

You can see the fee breakdown on the left, and the total expense on the right (1.03%, which is high!). You can find a Vanguard 2060 fund for just 0.08%.

Source: Capitalgroup.com Fund: American Funds 2060 Target Date

Compare the historical return of the fund you’re invested in vs. a similar fund net of the EXPENSES.

A fund with a higher fee could very well bring you higher returns even after the fee, making it worth it.

However, it can also go the opposite way and not be worth it at all after fees.

So Dave might be great to follow for budgeting advice… but, you may want to stick to the Daily Dough for investing ideas.

It’s clear that his investing method is out of date and not considering returns after fees.

What's Driving Up Mortgage Rates? 🏠

Wondering why buying a home feels like lighting your cash on fire?

You can thank the highest mortgage interest rates of the century… so far.

And what’s causing rates to skyrocket faster than bond yields?

Look no further than the "mortgage spread".

It's the gap between 10-year Treasury yields and your 30-year mortgage rate.

In simpler terms, when Uncle Sam needs to borrow money, he issues 10-year Treasury bonds. These yields set the stage for your mortgage rate.

Add in a bump of 1.5 to 3%—that's the lender's margin—and voila, you get your rate.

Seems straightforward, right?

Not quite. Numerous factors are turning this equation on its head.

Let's talk about one: the housing market's stalemate.

Home owners with low interest rates are clutching to their homes like a fat kid with his last candy bar…

And buyers can't afford the payment at current rates.

The result? A locked market.

We all thought low interest rates were the new normal…

But then, boom!

We had a black swan event, and rates exploded at the fastest rate in history.

To boot, we’ve seen mortgage spreads at their highest levels since the 1980’s!

Mortgage spreads have been hovering around 3% for the past year…

And the higher bond yields go, the higher mortgage rates will climb.

So where do we go from here?

Well, something has to give.

If mortgage rates keep climbing, or even hang out in in the 8% range, the real estate market is in BIG trouble.

The only clear sign of buying happening right now is from builders who are significantly buying down interest rates.

For example, Lennar, one of America’s largest home builders, is offering to buy down rates by about 3%.

These rate buydowns are the only way it makes sense for most buyers to get into a new home.

And until rates come down or prices implode, we’re likely to continue to see a locked market.

What To Watch This Week 👀

Central banks in the US, UK, and Japan all held interest rates steady at their meetings last week, but that didn’t stop the bond market from doing its own damage.

US Treasuries sold off broadly, causing yields to rise and stocks to fall.

This week the price action in bond markets could once again determine the fate of other tradable assets from stocks to crude oil to crypto.

Investors moods have also turned sour ahead of a possible US government shutdown and an ongoing United Autoworkers strike that threatens GM, Ford, and Stellantis.

Earnings from Costco, Nike, and CarMax will be key for reading the current state of the consumer. We’ve seen a lot of new lows in the retail & restaurant sectors lately…

We’ll also have to keep an eye on the following macro data releases:

Durable Goods orders

Inflation reports in the EU

US Personal Income & Spending for August

Manufacturing reports in China & Japan

There weren’t many bright spots in the market last week, but uranium stocks were the exception. Spot uranium prices breached the $70/pound level for the first time since 2011!

Here are the sectors making moves lately:

📈 Rising

Uranium (SRUUF)

Volatility (VIX)

Insurance (KIE)

📉 Falling

Consumer Discretionary (XLY)

Regional Banks (KRE)

Airlines (JETS)

Retail (XRT)

Tech (QQQ)

Alternative Energy (TAN)

REITs (XLRE)

Homebuilders (XHB)

We’re digging into stocks hitting new lows lately, so as the market correction continues the Daily Dough will be bringing our readers plenty of fresh ideas!

"Can I Retire Early?" 📺

In today's video, one of our readers asked us to answer the question - “Can I Retire Early?”

So, Nikki breaks down her income, expenses, assets, goals and gives her an action plan.

Food For Thought 🧠

"Retirement is when you stop living at work and start working at living.”

- Anonymous

How did you like today's newsletter?Let us know how we can deliver value. |

DISCLAIMER: We are not investment advisors, and this content is for educational purposes only. We don’t offer financial, legal, or tax advice. Nothing we say is a recommendation to buy or sell any assets. Trading and investing are extremely risky, so please be careful and do your own research.